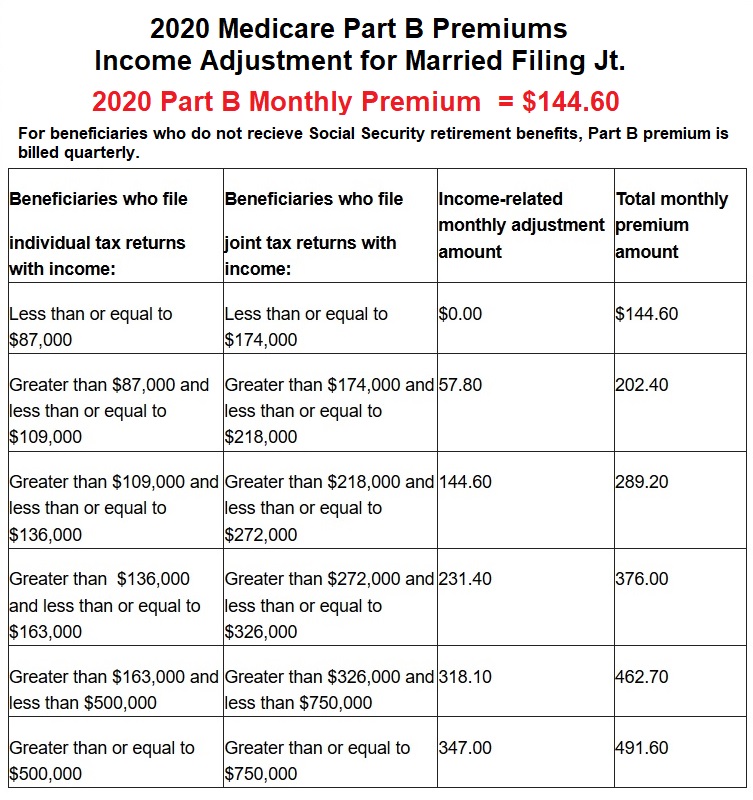

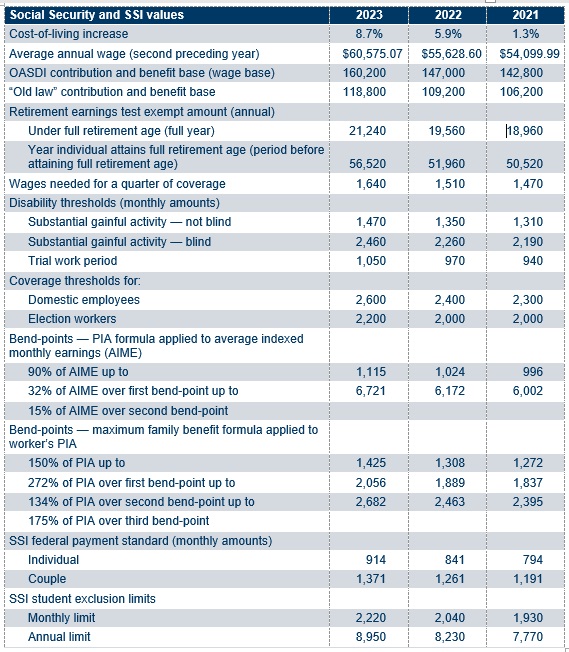

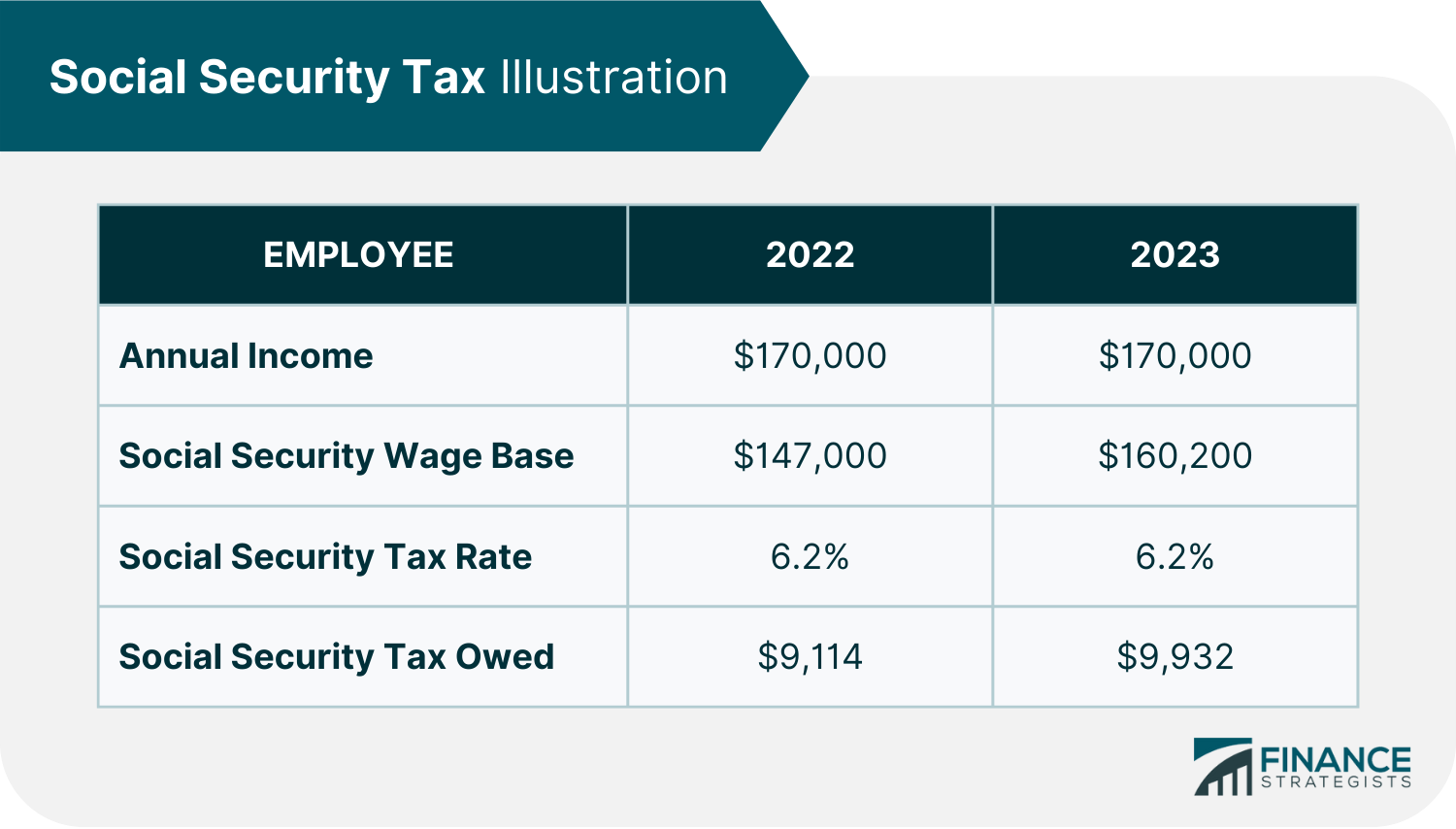

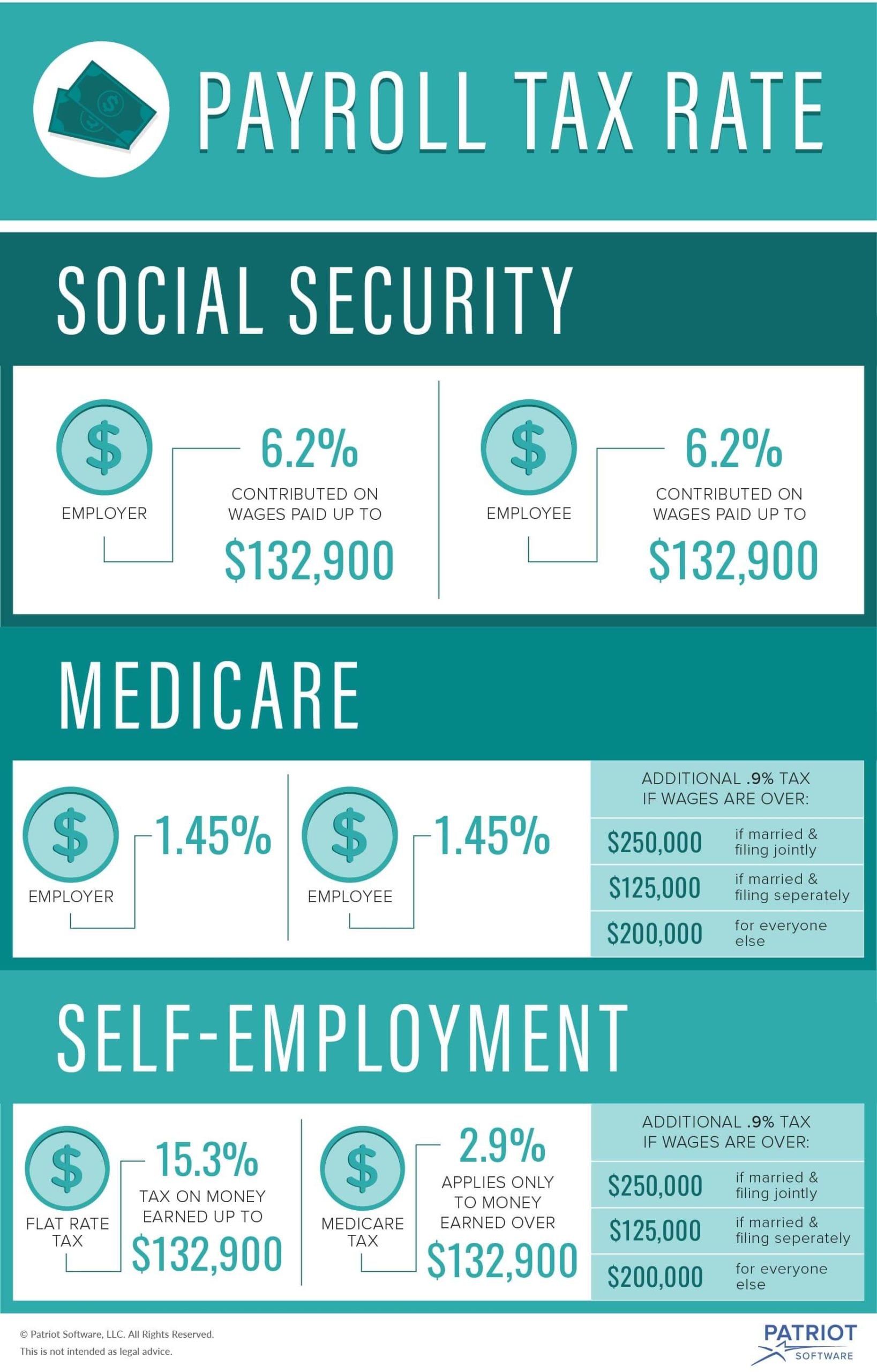

Medicare Tax Limit 2025 For Social Security - 2025 Limits For Medicare Premiums June Sallee, Different agencies use different inflation factors, but social security used 3.2 for increasing the numbers for 2025. The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600. Medicare Tax Limits 2025 Jodi Rosene, [3] there is an additional 0.9% surtax on top of the standard 1.45% medicare tax for. In 2025, the medicare tax rate is 1.45% for an employee and 1.45% for an employer, for a total of 2.9%.

2025 Limits For Medicare Premiums June Sallee, Different agencies use different inflation factors, but social security used 3.2 for increasing the numbers for 2025. The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.

Limits For Medicare Premiums 2025 Betsey Mellicent, In 2025, the threshold goes up to $168,600. There is no maximum wage limit for the.

Tax rates for each social security trust fund. Section 194p of the income tax act provides for exempting senior citizens from filing income tax returns aged 75.

Social Security And Medicare Withholding Rates 2025 Hali Prisca, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025). The 2025 limit is $168,600, up from $160,200 in 2025.

2025 Medicare Tax Rates And Limits Flori Jillane, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). For 2025, the social security tax limit is $168,600 (up from $160,200 in 2025).

Social Security Extra Help Limits 2025 Cloe Melony, Social security tax rate for 2025: (for 2025, the tax limit was $160,200.

In 2025, any individuals with earned income over $168,600 stop paying social security tax for the remainder of the year.

2025 Social Security Tax Percentage Josey Mallory, Tax rates for each social security trust fund. If you have a higher income.

Maximum Social Security Tax 2025 Nanny Malissa, If your income has gone down. For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Limit On Social Security Tax 2025 Kelcy Melinde, Like social security tax, medicare tax is withheld from an. In 2025, the threshold goes up to $168,600.

Understanding FICA, Social Security, and Medicare Taxes, You’re responsible for paying half of this total medicare tax amount (1.45%) and your employer is. In 2025, you paid social security taxes on work income up to $160,200.

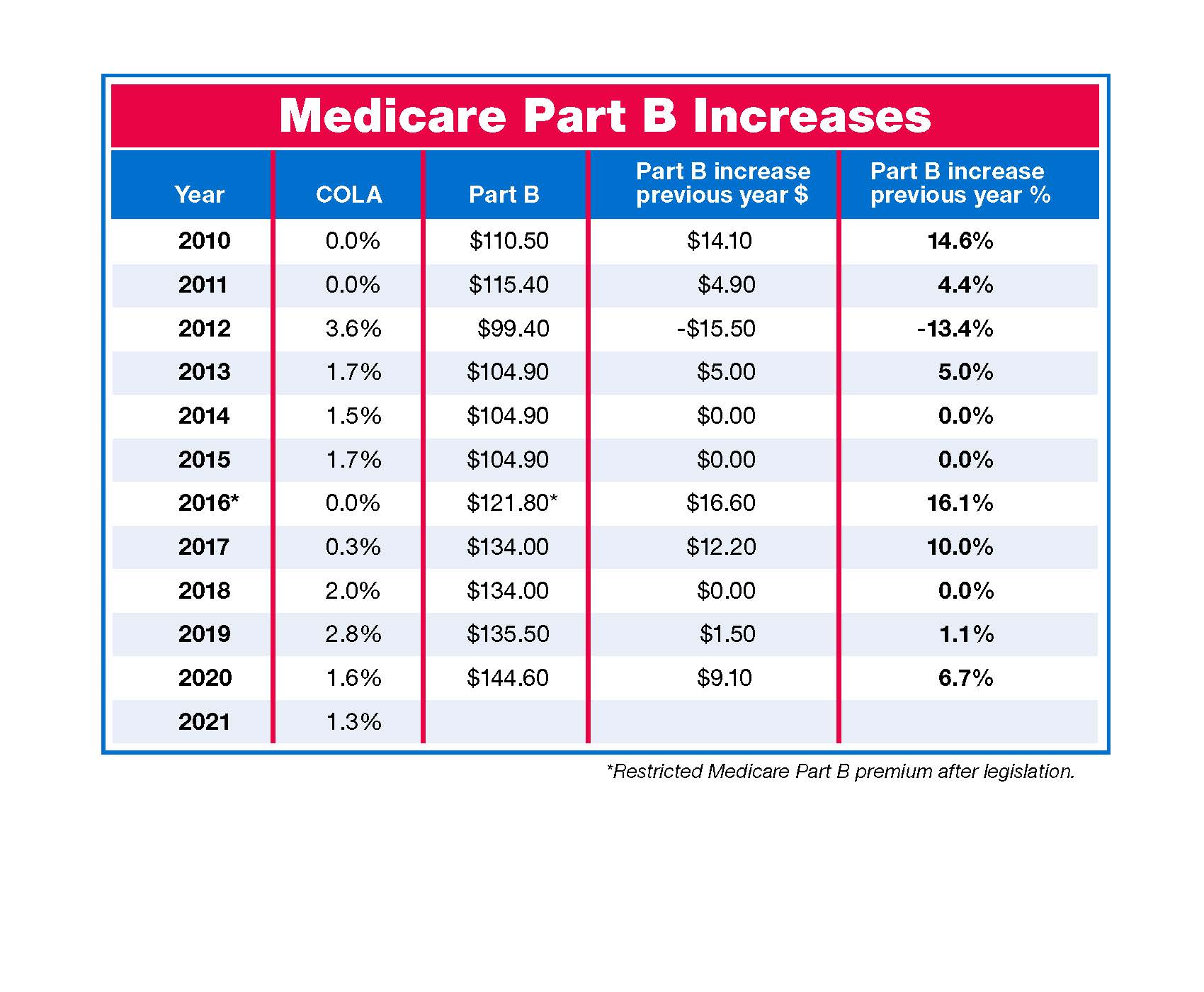

Medicare Tax Limit 2025 For Social Security. So, if you earned more than $160,200 this last year, you didn't have to. Below is a chart that states numbers for the following:

Unlike the social security tax, medicare tax has no.